A company with high organic growth

Picture: Alfen

One of the fund’s holdings that has made a strong positive contribution to the fund’s return is Alfen. Alfen is a Dutch company that divides its activities into three divisions. The company produces charging stations for electric cars, develops and sells various energy storage solutions and develops and sells solutions for efficient and seamless transmission of electricity. The charging station business and the energy storage solutions are expected to give the company as a whole strong growth in the coming years, while the energy transmission market has somewhat more modest growth expectations.

The number of electric cars is expected to grow strongly in the coming years in Europe and by 2030 there are likely to be almost no new cars sold in Europe that are not in some way chargeable. This will create a huge network of charging stations and it is expected that the number of charging stations in Europe will increase tenfold before 2030, which should lead to an exciting market for Alfen, which aims to be a leading player in the sector. The market for various types of energy storage is also expected to grow strongly as the need to store renewable energy increases significantly.

The sun doesn’t shine all day and the wind doesn’t blow all day, there may be periods when it does neither the one nor the other. Mechanisms will therefore be needed to guarantee the supply of electricity despite this, and cost-effective and flexible energy storage is the solution. Moreover, the markets for Alfen are supported by policy initiatives and regulations that have objectives to accelerate the transformation to fossil free.

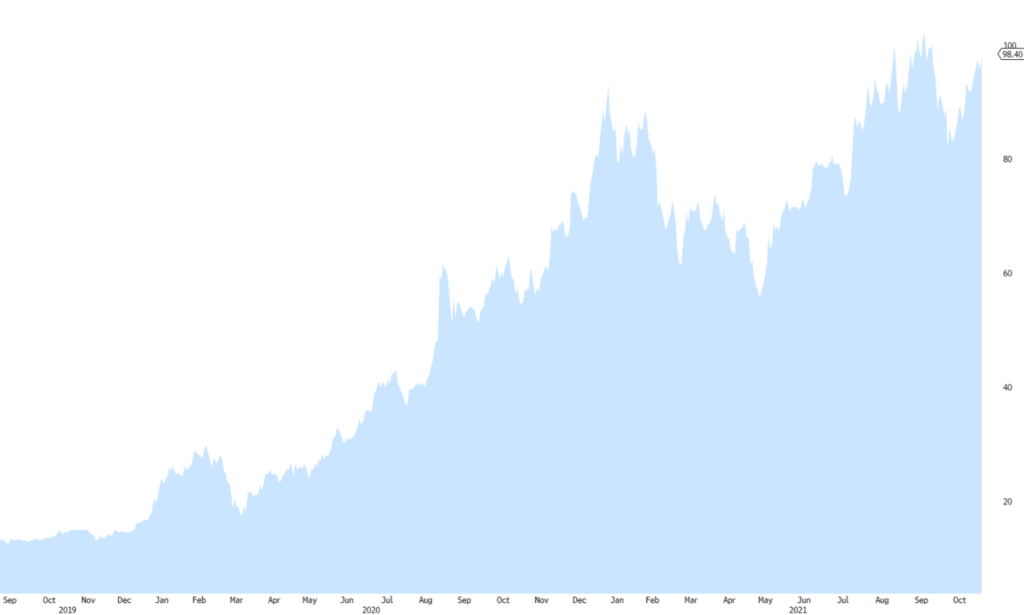

Performance chart of Alfen since September 2019 when the fund made its first investment in the company:

Time period: 01.09.2019-2.11.2021, source: Bloomberg.

Of course, a company like Alfen is not cheap, but on the other hand, few companies are in a market that allows for organic growth of 30-40% annually. As a result, the level of risk is obviously high, as the high valuation leaves no room for disappointment. Despite a high valuation, we think the company is an interesting investment and fits perfectly into Fondita Sustainable Europe.