Why we want to have exposure to Renewable Energy

The International Energy Agency (IEA) issued a report on the 6th of December that supports our view that renewable energy is a segment expected to grow even faster than previously anticipated and therefore an industry we want to have exposure to. Below I will try to summarize the most relevant observations and predictions for the next 5 years.

The executive summary of the report starts with the statement “The first truly global energy crisis, triggered by Russia’s invasion of Ukraine, has sparked unprecedented momentum for renewables”. According to the report renewable capacity expansion will be much faster than what was expected a year ago. It is now expected that renewable capacity globally grows by 2 400 GW over the next 5 years, which is 85% more than the previous 5 years and 30% more than what was forecasted a year ago. The upward revision in the forecast is driven by China, EU, USA and India, which are all implementing regulatory and market reforms. China’s 14th Five-Year Plan, The REPowerEU plan and the US Inflation reduction Act are the main drivers for the revised forecast. The capacity growth in Europe is expected to be somewhat higher due to the invasion of Russia and the resulting European energy crisis.

“Renewables is the only electricity generation source expected to grow during the next 5 years”

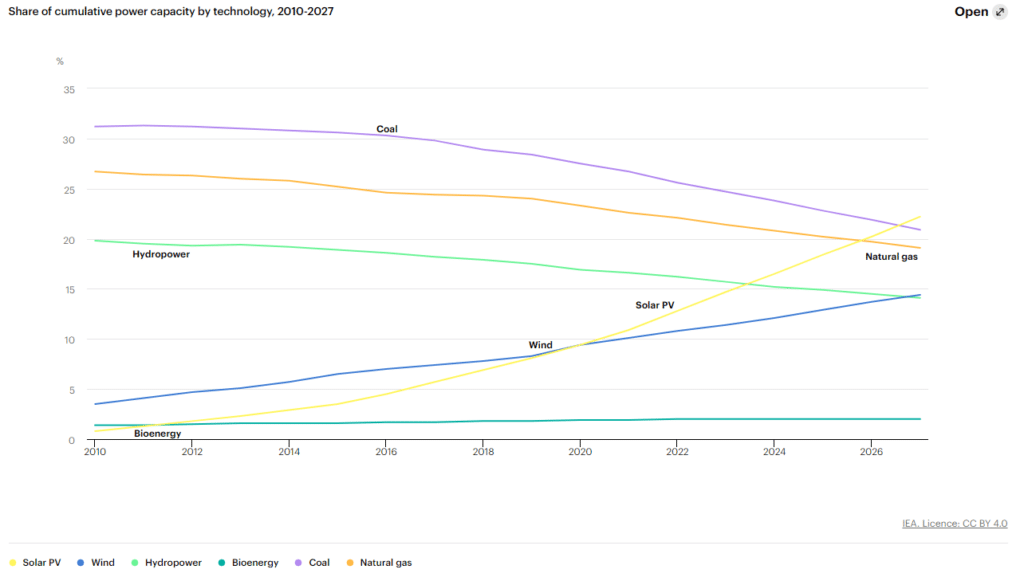

“Renewables becomes the largest source of global electricity by early 2025, surpassing coal” is forecasted in the report. The share of renewables will reach 38% by 2027, up by 10% from today’s levels. Renewables is the only electricity generation source expected to grow during the next 5 years. Global wind capacity is expected double and solar to triple during the forecast period. Especially the offshore wind industry offers interesting opportunities in our view over the coming decade.

All in all, the capacity expansion is accelerating, which of course is positive. On the other hand, even if the IAEs forecasts are realized we would still fall short of the targets set in the REPower EU plan, partly because of sluggish penetration of renewables withing transportation and residential heating/cooling. The same goes for various other climate-related goals and initiatives. It seems these targets can only be reached if we put even stricter policies and regulation in place, which we expect will happen.

Picture: Share of cumulative power capacity by technology, 2010-2027 (Source: IAE)

The biggest risk to IAE’s forecasted growth materializing seems to be the severe bottlenecks within the permitting processes for building the actual wind and solar parks. This is highlighted in the report and is certainly confirmed in discussions we have had with renewables companies. The report states that global renewable capacity can expand by an additional 25% compared with the current forecast, if countries address policy, regulatory, permitting and financing challenges. We do however believe that things are slowly starting move in the right direction in that area as well.

We have two funds that are focused on capturing structural growth within climate- and environmentally smart solutions. The first one is Fondita Sustainable Europe which solely invests in European companies with climate-and environmentally smart solutions. Currently the fund has an exposure of approx. 30% towards renewable energy in different shapes and forms, mainly wind power. Fondita Global Megatrends, in turn, is a global fund with three different thematic focus areas of which one is environmentally and climate smart solutions, the other two are health &wellbeing and tech/digitalization. Fondita Global Megatrends naturally has some exposure towards renewable energy within the climate- environmentally smart solutions segment. We also have some exposure to renewable energy in our other six funds as well.

Marcus Björkstén, Portfolio Manager