Meeting Swiss companies – Portfolio Manager’s thoughts and insights

I started the year by meeting Swiss companies presenting at Baader Helvea Swiss Equities conference. Some 300 investors had meetings with 80 companies representing several different industries. As always it was great to feel the pulse of the management teams and meet fellow investors from different countries.

PM Janna Haahtela and the conference venue.

I focused my time mainly on meetings with portfolio companies or companies active in the healthcare sector but also met some industrial and tech names. 16 company meetings in total. Fondita Healthcare currently has a 21% weight in Swiss companies, and I had the possibility to discuss current operations and company strategy with 4 out of 7 of our holdings, namely Coltene, Siegfried, Tecan and Roche. A good mix of companies active in dental consumables, diagnostics, pharma and contract manufacturing in drug production and drug substances. I also spent some time with biotech companies to get a feeling of interesting ongoing clinical developments.

All in all, for 2023 companies remain quite hopeful and confident while at the same time being fully aware of possible macro-related headwinds, recession risks and change in customer behaviors. Inflation worries seems to have eased a bit, supply chains are also normalizing, and the opening of China is a positive plus. Robust business models will help to navigate challenges caused by inflation and higher interest rates and some companies even highlighted gradual improvements in the business environment. So, a positive atmosphere compared to maybe a bit more pessimistic investor sentiment. Fundamentals are not as bad as some share prices might perceive.

For healthcare companies covid-related business is expected to be marginal for 2023. Roche will have to compensate up to CHF 5bn of covid-related sales in 2023. Siegfried has vaccine production capacity that needs to be filled with other CDMO business (up to 4% of sales). Tecans covid-headwinds are also getting smaller, and the company is guiding for CHF 60m as we enter 2023. For all, the shortfall is compensated to some or full degree by growth in other segments thanks to a more normal post pandemic environment.

My first meeting upon arrival was with Coltene, a manufacturer of premium dental consumables and small dental equipment’s. Coltene has been a holding in Fondita Healthcare and Fondita European Micro Cap since inception.

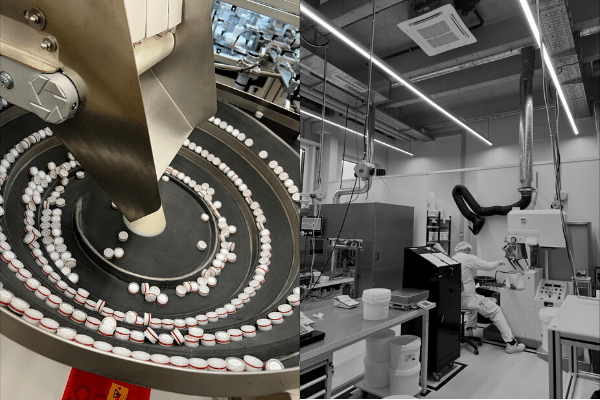

Coltenes manufacteuring site in Altstätten

After further discussions with the CEO and CFO I got invited to visit their nearby factory a couple days later, to continue discussions and tour the Altstätten facility. I can’t emphasize enough how valuable it is to visit a company and see firsthand production facilities and get a perception of company culture. In Coltenes facility they had both corporate functions as well as manufacteuring of instruments and materials for dental preservation and efficient treatments.

Coltene had strong demand in 2021 that continued into 2022, with exceptionally high demand of surface disinfection which has normalized in 2022. Coltene, that has a stable cash generative business, wants to grow faster than the overall dental market. Around 70 % of Coltene’s business is pain related, which is non-cyclical, and this gives stability. Coltene’s organization is lean and fast, and they are open for M&A with a healthy balance sheet. The company is also considering expanding its operations in China where it has been growing 15-20 % annually. Currently 46% of sales comes from North America, 37 % from Europe and 11 % from Asia.

Other companies I met in Bad Ragaz were Newron pharmaceuticals, SKAN, HBM Healthcare Investments, Tecan, Galenica, Siegfried, Molecular Partners, Sulzer, Coltene, Addex Therapeutics, Zehnder group, ASMALLWORLD, Inficon, Vetropack, Phoenix Mecano and Roche.

Janna Haahtela, Portfolio Manager